Women and investing: reduce the gender gap

24.03.2023 /

The investing world is still an area where women are massively under-represented. Indeed, men dominate wealth and asset management, both from a financial advisor’s job side as well as from the key financial decision-makers in the household. The general stereotype that women are less talented when it comes to managing finance is persisting even today in some people’s minds.

Though, the financial influence of women is only set to grow in the near future. McKinsey* is projecting that by 2030, in the US, women will control the largest part of USD 30 trillion in financial assets that baby boomers will own. It is thus fundamental to understand what is influencing women’s philosophy when it comes to investment and how it differs from the typical behavior observed by men.

Let us go back in time. Historically, women were less independent when it comes to finance. Often not-working, they were over-relying on their husband and thus had little income to invest. This is not the case anymore, where women are increasingly present in the job market. With the sad reality that nowadays, on average, one wedding over two ends in a divorce, women thus want to keep control of their wealth as a growing necessity.

Salary gap

However, some trends persist and are explaining partially certain differences. In fact, women are still suffering from inequalities in salaries.

However, some trends persist and are explaining partially certain differences. In fact, women are still suffering from inequalities in salaries.

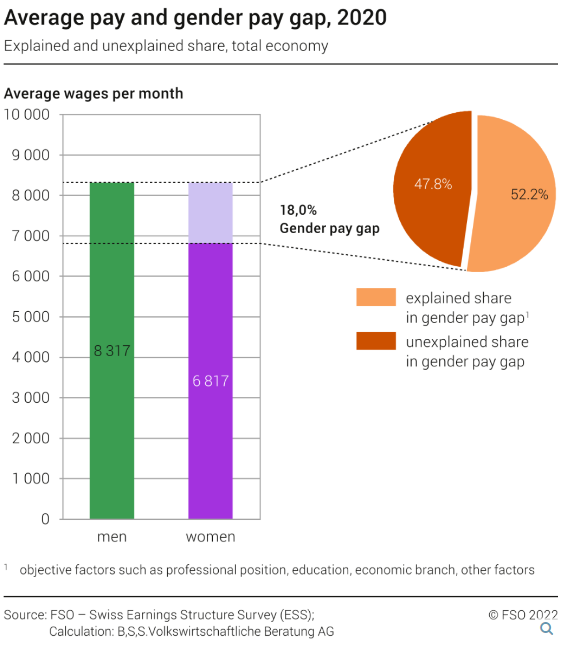

Indeed, a recent analysis in 2020 from the Federal office for gender equality in Switzerland** is showing that, on average, there is an 18% gap on the paycheck between women and men. Almost half of this pay gap remains unexplained by professional status, years of service, or qualifications and thus can potentially be related to gender discrimination.

Also, the women’s career path is more irregular, as they are still, for the majority, the ones in the household taking career breaks to raise families and thus are suffering from a potentially high period of income disruption. They are additionally more inclined to work part-time.

A different behaviour

All these differences are often cumulative and are increasing over time. This is creating a massive impact in terms of accumulation of wealth and thus affecting women’s savings and their ability to invest. Women are behaving differently than men when it comes to investment, partly motivated by the differences mentioned above and driving fear of volatility and instability when it comes to women’s finance.

Women are more risk-averse and often suffer from a too conservative investment behavior. They also tend to invest with a longer-term focus, to prioritize long-term stability over short-term gains. In fact, women tend to be less inclined from investing in financial markets and are suffering from a too big portion of their assets in cash while consistently underweighting equities compared to men. On a multi-year approach, these different approaches are impacting severely returns.

Encourage investment awareness

Another blocker is the lack of knowledge. According to a PIMCO research***, 72% of women believe investing is set up to be confusing. More than half of interviewed women say the financial services industry does not reflect their lifestyles or realities. This can also be explained by their underrepresentation in the investment community, where men are dominating.

There is thus still a long way to go in terms of investment awareness for everybody to select the most appropriate asset allocation on a long-term basis. We believe having an investment advisor explaining financial markets and selecting the adequate asset allocation for portfolios is a first step to getting rid of these unneeded biases driven by societal differences. One needs to understand that investing adequately – by non-having a too strong underweight or overweight – over the long-term is crucial to reduce the gender gap.

Julie Attanucci, Analyst, Investment Group

***https://www.pimco.ch/en-ch/our-firm/diverse-perspectives